Qualifications

Leonardi Family Wealthcare specializes in comprehensive estate strategies, business succession, retirement, and investment planning, as well as related insurance and investment strategies for high-asset individuals.

With over 30 years of experience in the financial services industry, I bring a wealth of knowledge and expertise to both new and existing clients. Prior to founding Leonardi Family Wealthcare, I served as a private wealth advisor with Osaic FA (formerly Lincoln Financial Advisors), where I built a successful individual practice focused on delivering personalized financial solutions.

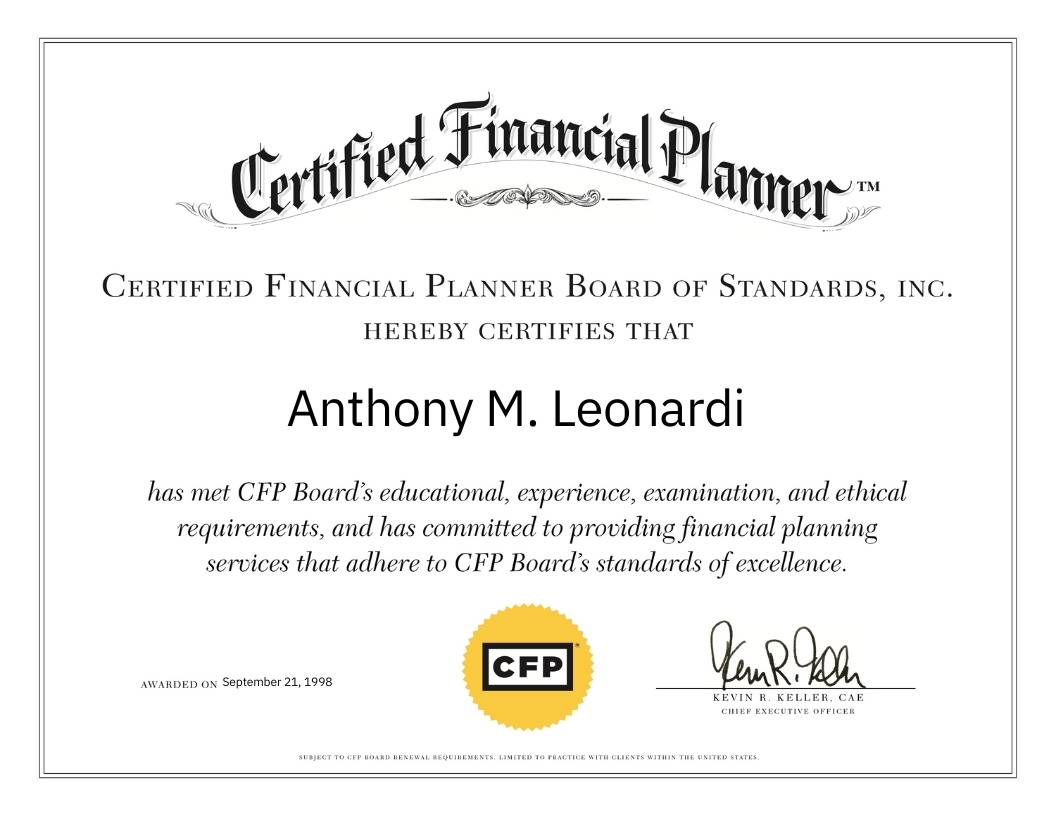

I hold an MBA from the University of Connecticut and have earned the CERTIFIED FINANCIAL PLANNER (CFP®) certification and Chartered Retirement Planning Consultant (CRPC®) designation from the College for Financial Planning.

The CFP® certification is one of the most recognized and respected credentials in the financial planning industry. Earning this certification requires:

- Extensive Education: CFP® professionals complete a rigorous curriculum covering a wide range of topics, including investment management, retirement planning, tax strategies, estate planning, and insurance.

- Experience Requirements: Candidates must complete at least 6,000 hours of professional financial planning experience or a 4,000-hour apprenticeship under a qualified mentor.

- Comprehensive Exam: The CFP® certification exam is a challenging multi-day test designed to ensure competency in real-world financial planning scenarios.

- Ethics and Continuing Education: CFP® professionals commit to upholding high ethical standards and must complete 30 hours of continuing education every two years to stay updated on changes in laws, regulations, and financial strategies.

This certification reflects my dedication to providing the highest level of expertise and ethical guidance to my clients, ensuring they receive advice tailored to their unique goals and circumstances.

The CFP® certification process, administered by CFP Board, identifies to the public that those individuals who have been authorized to use the CFP® certification marks in the U.S. have met rigorous professional standards and have agreed to adhere to the principles of integrity, objectivity, competence, fairness, confidentiality, professionalism and diligence when dealing with clients. The mission of Certified Financial Planner Board of Standards, Inc. (CFP Board) is to benefit the public by granting the CFP® certification and upholding it as the recognized standard of excellence for competent and ethical personal financial planning.